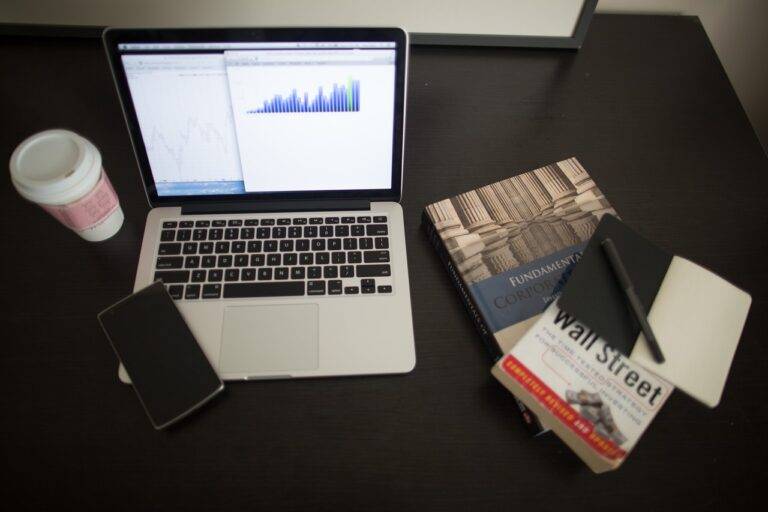

The Impact of Tech on Financial Services

The integration of artificial intelligence and machine learning algorithms has revolutionized the way financial services operate. These technologies are being used to analyze large volumes of data with high accuracy, allowing for better risk assessment, fraud detection, and personalized customer experiences. Additionally, the automation of routine tasks through these advancements has increased operational efficiency and reduced human error in financial institutions.

Blockchain technology has emerged as a game-changer in the financial sector, offering secure and transparent transactions without the need for intermediaries. The decentralized nature of blockchain enables faster and cheaper cross-border payments, making it an attractive solution for both businesses and consumers. Moreover, smart contracts built on blockchain are streamlining processes such as loan approvals and insurance claims, leading to greater efficiency and cost savings for all parties involved.

Enhanced Customer Experience Through Technology

The integration of cutting-edge technology in the financial services sector has revolutionized the way customers interact with their banks and financial institutions. From digital banking platforms to AI-powered chatbots, these advancements have not only streamlined processes but also personalized the customer experience. By leveraging data analytics and machine learning algorithms, financial service providers can now tailor their offerings to meet the individual needs and preferences of each customer.

Additionally, the use of biometric authentication methods, such as facial recognition and fingerprint scanning, has significantly enhanced the security of customer accounts and transactions. These technologies not only provide a more secure way for customers to access their accounts but also offer a more convenient and user-friendly experience. As more financial institutions continue to invest in these innovative technologies, the customer experience in the financial services sector is expected to further improve, ultimately creating a more seamless and enjoyable interaction for customers.

How can technology enhance customer experience in financial services?

Technology can enhance customer experience in financial services by providing convenient and efficient ways for customers to access their accounts, make transactions, and receive personalized services.

What are some key technological advancements in the financial services industry?

Some key technological advancements in the financial services industry include mobile banking apps, biometric authentication, artificial intelligence for customer service, and blockchain technology for secure transactions.

How can customers benefit from these technological advancements?

Customers can benefit from these technological advancements by enjoying faster and more convenient banking services, increased security for their transactions, personalized recommendations based on their financial behavior, and access to their accounts anytime, anywhere.

Are there any potential drawbacks to relying on technology for customer experience in financial services?

While technology can greatly enhance customer experience, there are potential drawbacks such as security risks, technical glitches, and the risk of customer data being compromised. It is important for financial institutions to continuously update their technology and security measures to mitigate these risks.